From Memes to Macro: Why Thematic Indexes Are the Next Meta

Markets follow narratives.

Whether it’s a cultural moment, a major policy shift, or a new wave of tech, capital tends to flow where the narrative is strongest. Thematic investing - structuring exposure around ideas instead of just sectors - has been a powerful tool for years, but it’s rarely been within reach for anyone outside the institutional world.

That’s changing. Index.fun makes it possible for almost anyone to build and launch structured thematic indexes entirely on-chain. And the implications go well beyond speed or cost.

It changes who gets to define investable trends in the first place.

The Problem with Thematic Indexes Today

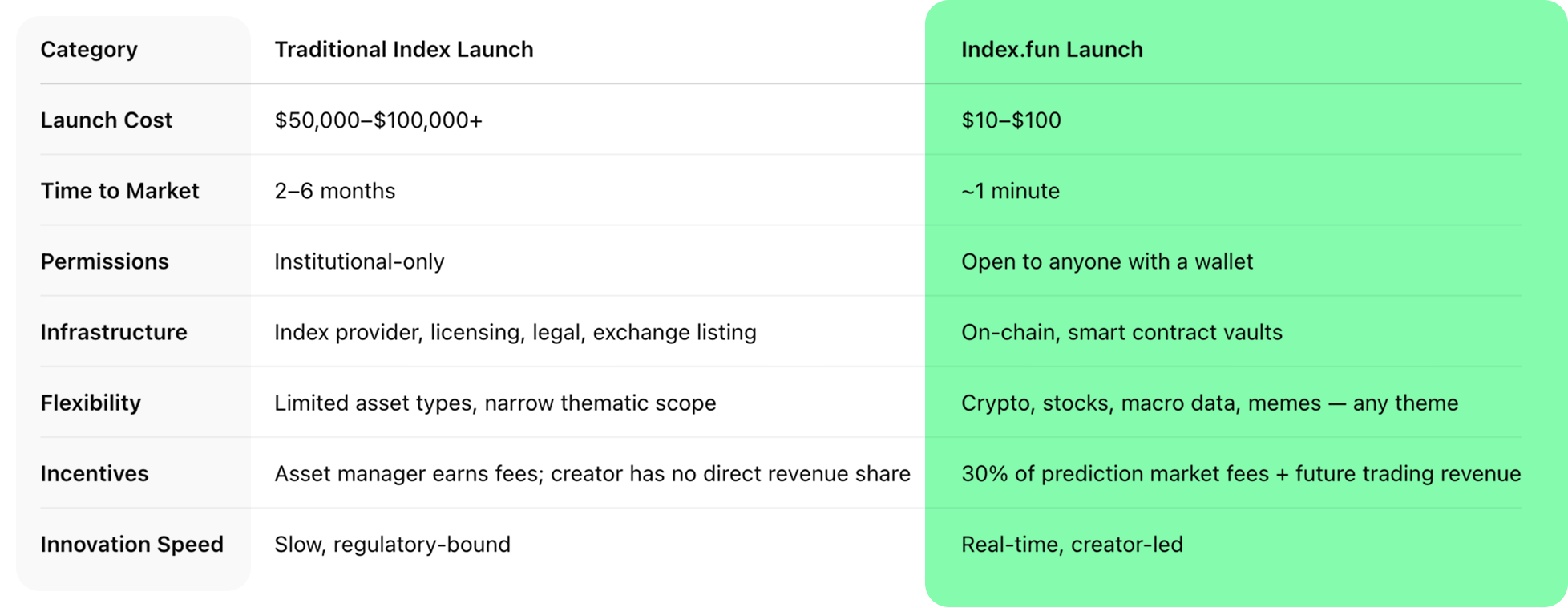

In traditional finance, building a thematic index is a multi-layered process involving licensing, distribution deals, methodology design, legal reviews, and a hefty budget. Launch timelines can drag on for months. Even then, the result is often a narrow, pre-approved basket that fits within regulatory and brand constraints. Most creative or fast-moving narratives never even make it past the drawing board.

Index.fun cuts through that bureaucracy.

With a wallet and an idea, anyone can publish a functioning, monetized index in minutes — no middlemen, no permissions. These indexes can include crypto, equities, real-world data, or any combination thereof. And they can reflect any trend, from the serious to the satirical.

Turning Trends Into Tradable Instruments

This makes thematic indexes far more expressive. Someone tracking macro volatility in the UK can now structure a real-time "UK Black Swan" index and let the market decide how it performs. An observer of U.S.-China relations might build a tariff-sensitive index in response to emerging trade policy. Or, say, someone following Elon Musk’s every move can construct a product that wraps together the assets most correlated to his brand and behavior.

This isn't just about speed. It's about making indexes a more dynamic, narrative-driven instrument — something closer to a statement than a product. On Index.fun, that statement can be tested in the market right away, with liquidity, speculation, and data all feeding back into the product’s performance.

Prediction Markets Meet Index Strategy

What makes this even more interesting is how prediction markets are integrated into the system. Every index becomes a live sentiment gauge — one where traders can speculate on whether it’s heading up or down in real time. The result is part index, part market, part signal.

Rethinking Incentives: From Passive Product to Active Revenue

The incentives are different too. In legacy finance, only licensed fund managers or asset issuers have access to index monetization. Here, index creators earn directly from platform activity — both from prediction market volume and, soon, tokenized trading. That opens the door for independent thinkers to build products that not only express conviction but also generate recurring revenue.

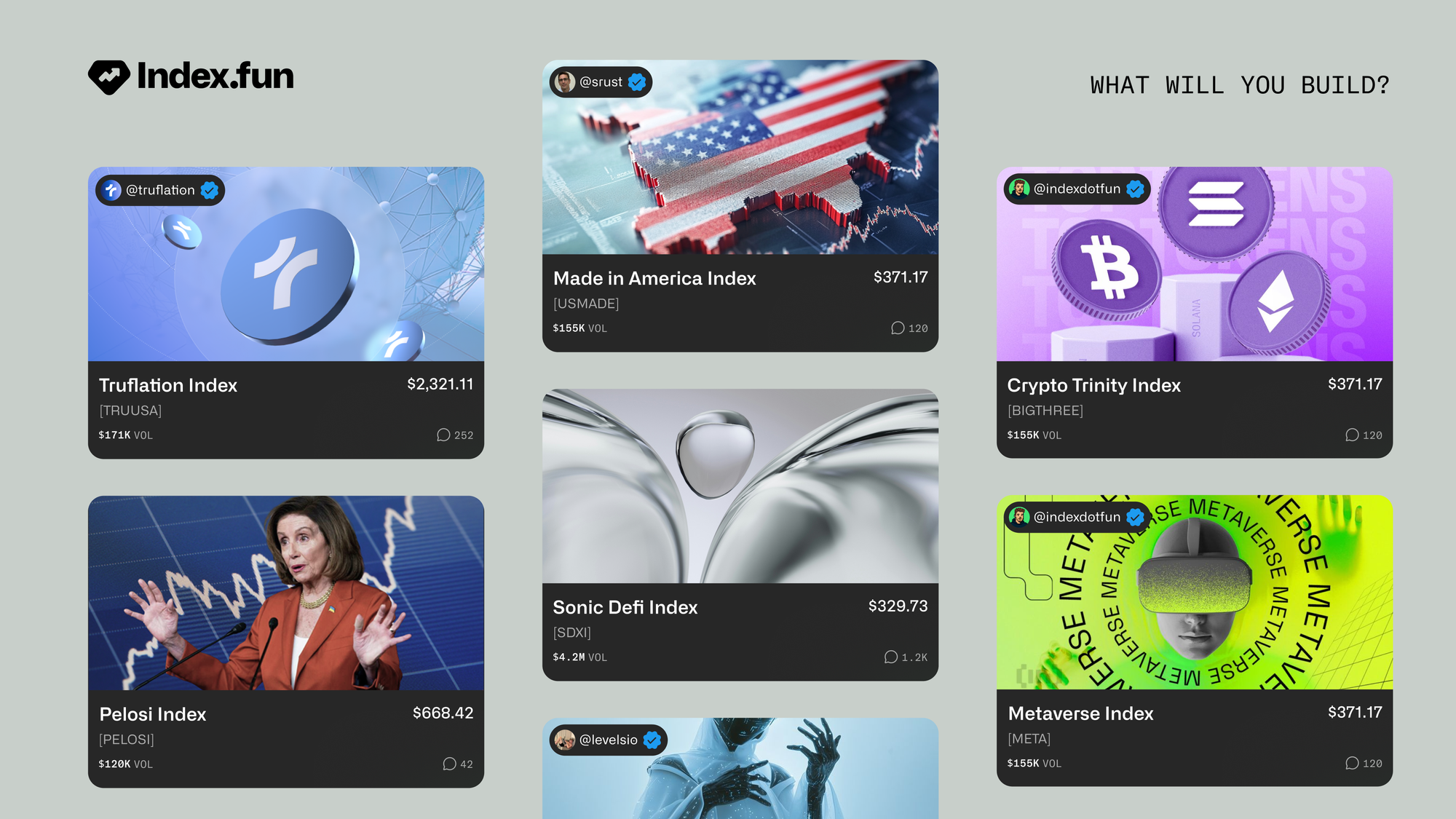

The indexes already showing up on the platform range from playful to prescient. The Elon Index tracks assets tied to Musk’s influence — from Tesla and DOGE to meme coins circulating on social media. The Fight CEO Index curates companies led by combat-sport-inclined executives, blending performance theory with personality branding. On the more strategic end, the UK Black Swan and Tariff Tracker indexes reflect macro and policy-based exposures that would normally take months to formalize elsewhere.

What’s clear is that these products aren’t constrained by old playbooks. They’re programmable, composable, and built to move as fast as the story they follow. And they’re open to anyone with the insight and curiosity to create one.

The Future of Thematic Investing Is Creator-Led

As financial institutions continue to push sanitized thematic ETFs through slow-moving distribution channels, Index.fun offers something different: rapid, decentralized index creation built for an internet-native financial audience. It’s a model that favors creativity, speed, and transparency — and one that reflects where markets are actually going.

A thematic index doesn’t have to be something you wait for someone else to launch. It can be something you build — today.

The meta is evolving. And increasingly, the index is the meta.

Demo now — app.index.fun